I recently attended the ICCA Northeast Quarterfinal a cappella competition at Berklee School of Music. If you don’t think that’s a big deal, you don’t know what you’re missing.

Humans have been singing since, well, ever since we’ve been human. For eons we’ve raised our voices: alone; in unison; in harmony. Over time we developed instruments that mimic the human voice. But there’s always been power in the voice alone. Think Gregorian chant. Think the finale of Bernstein’s Candide, or Beethoven’s Ninth, when the orchestra drops away and the chorus alone elevates our emotion.

The term for people singing without instruments is, a cappella, which comes from the Italian for “in the style of the chapel.” In the 19th-century United States, we developed a secular form of a cappella known as barbershop quartet. Barbershop is characterized by four-part close harmony, traditionally performed by men. Barbershop has roots in the African-American community, but like other American art forms, was adapted, transformed, and ultimately popularized among white Americans. In fact, barbershop evolved to epitomize a kind of wholesome, hometown Americana of family men wearing matching seersucker jackets and straw hats, singing in the gazebo on the town green on the Fourth of July. Barbershop songs are short in length, cute in lyric, light on emotion (except for pure love), and rich in harmonics. As such, it well represents the dominant culture of its time.

Barbershop mania peaked at the turn of the last century, and became passé by the 1920’s. As often happens when art forms cease to evolve, barbershop has now been institutionalized and fossilized. The Barbershop Harmony Society (for men) and Sweet Adelines International (for women) promote barbershop, even as they keep it fixed.

My personal experience with barbershop dates to 1973, when, as a college freshman, I joined the ‘Logarhythms,’ a four-part close harmony men’s group at MIT. We sang many traditional barbershop tunes, but also arrangements by The Beatles and Three Dog Night. The twelve of us in our matching shirts, crooning on stage, were culturally retrograde. But our concerts were a success, perhaps in part because we were so non-threatening and irrelevant.

Then, two things changed. The cordless mic ‘electrified’ a cappella and enhanced the range of sounds a human voice could produce. About the same time, Where in the World is Carmen Sandiego introduced a generation of young, impressionable minds, to the joys of a cappella though Rockapella, the house band for the popular PBS show.

Aside from maintaining collegiate affiliations,, a cappella has become a completely different art form. It’s a bit cooler (thanks to the Pitch Perfect movies). It embraces musical styles well beyond the American songbook. It’s hyper percussive, and highly choreographed. No more two-minute songs with a chorus and a bridge, a cappella groups today create ten-minute musical collages that weave song and story and bassline. And they’re no longer segregated by sex.

Fifty—yes fifty—a cappella groups performed at the ICCA quarterfinals, culled from over two hundred who submitted audition tapes. Five different shows, ten groups per night. Each group performing a ten minute set, judged on arrangements, choreography, soloists, and harmonies. The top two groups from each night will perform at the semi-finals, at Berklee Performance Center on March 28.

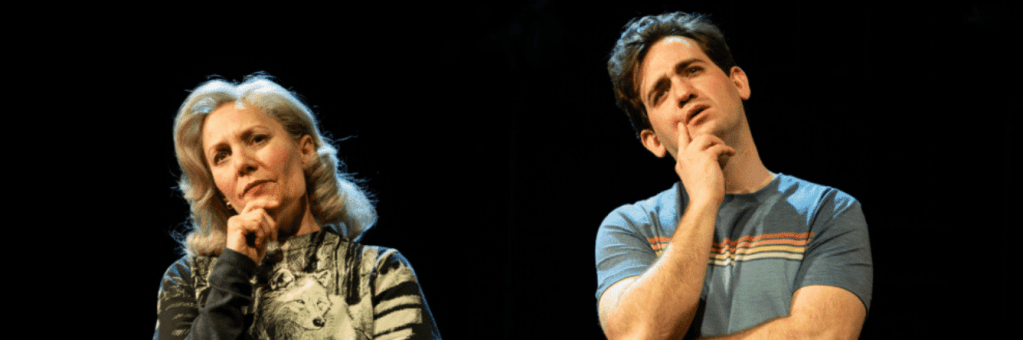

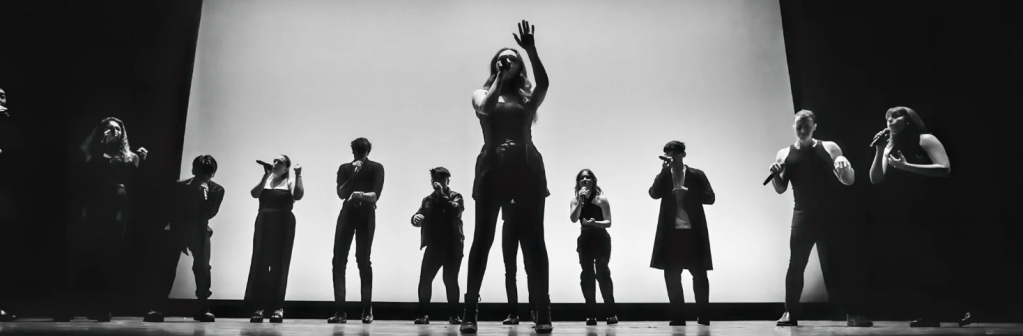

Our event kicked off with the Berklee ‘Treble Threat,’ an all-female group who delivered a pleasant set. They were followed by the Northeastern ‘Nor’easters,’ who live up to their name. Dressed in black rags, fishnets and sweats, they slivered on to the stage and delivered ten minutes of what can only be described as tragic opera. The music was continuous, all enveloping, and emotionally devastating. When it ended, I was exhausted. And in awe.

The remaining eight groups were all good, though none toppled the ‘Nor’easters’ fury. The most enjoyable was Bentley College ‘Off the Clock’ who poked fun of their business school’s reputation by sporting business suits and kicking off their set with a terrific rendition of Abba’s “Money, Money, Money.” The Marist University ‘Enharmonics’ distinguished themselves in white outfits suitable for a summer picnic. But the other groups were all grunge, grunge grunge. The Boston University’s ’Treble Makers’ earth tone rags could easily wardrobe a revival of Les Miserables.

The sentiments matched the look. The musical and choreographic themes were, again and again, the pain of loss, the futility of love, the angst of being human. Whatever they’re serving up at college these days, they ought to toss in a few happy pills.

I understand that happiness does not make for good drama, but the insistent alienation enacted on the Berklee Performance Stage was depressing. I left the event bowled by the talent of these young people, even as I despair over their view of our world.

In yesteryear, the barbershop quartet represented our culture—not accurately in so much as how we fancied ourselves. Today, a cappella is much more complex and rewarding in every aspect of performance. I only wish the mirror it reflects on our society were not so brutal.

But the performers must know what judges like. Second place at the event I attended went to Berklee ‘Upper Structure’ who were excellent though bleak. First place to Northeastern Nor’easters, the best of the bleakest by far.